How to Trade with the Spinning Top Candlestick IG International

We advise you to carefully consider whether trading is appropriate for you based on your personal circumstances. We recommend that you seek independent advice and ensure you fully understand the risks involved before trading. On its own the spinning top is a relatively benign signal, but they can be interpreted as a sign of things to come as it signifies that the current market pressure is losing control.

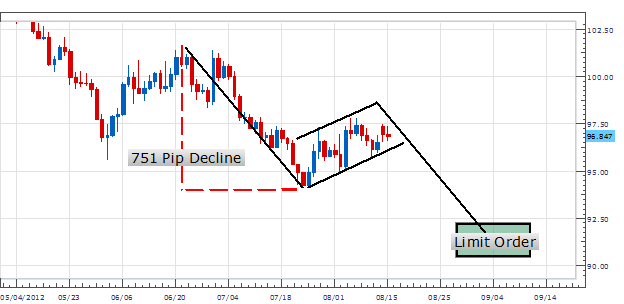

HowToTrade.com helps traders of all levels learn how to trade the financial markets. To completely validate a trend reversal, we also added Fibonacci levels from the highest to the lowest price levels of the prior trend. As you can see in the USD/CHF 1H chart above, the spinning top pattern appears at the top of a trend and has the following features – small body, long upper and lower shadows. Trading with the Spinning Top candle involves understanding how it is formed and where it sits in relation to the overall market trend. The example below goes through identification, confirmation and execution of a practical forex trade using the Spinning Top.

Understanding Spinning Top Candlesticks

Thankfully, there are two additional methods that we can use to confirm the spinning top patterns that offer the best trading opportunities, which we incorporated in our trading strategy below. From a supply and demand perspective, the spinning top forex pattern represents a period of indecision about the future direction of a market where neither buyers nor sellers could gain the upper hand. In this article, we will explore a very popular candlestick pattern – the spinning top forex pattern – what it means when you see this pattern on your chart, and how to trade it.

Trading with the Spinning Top Candlestick – DailyFX

Trading with the Spinning Top Candlestick.

Posted: Fri, 14 Jun 2019 07:00:00 GMT [source]

Price movements within the spinning top candlestick indicate that buyers and sellers are overriding each other, resulting in homogenous open and close price trends. Using the spinning top pattern in a trading strategy will help the trader work within the minimum suggested investment time. The formation of the candlestick indicates a level of indecision among buyers and sellers, which depicts price reversals, hence creating a neutral pattern.

A spinning top is a candlestick pattern with a short real body that’s vertically centered between long upper and lower shadows. The candlestick pattern represents indecision about the future direction of the asset. It means that neither buyers nor sellers could gain the upper hand. A spinning top indicates exhaustion after a cycle of uptrends or downtrends price pattern.

How To Trade The Spinning Top Candlesticks

Any research provided does not have regard to the specific investment objectives, financial situation and needs of any specific person who may receive it. It has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. Although we are not specifically constrained from dealing ahead of our recommendations we do not seek to take advantage of them before they are provided to our clients. When a market’s open and close are almost at the same price point, the candlestick resembles a cross or plus sign – traders should look out for a short to non-existent body, with wicks of varying length. A hammer shows that although there were selling pressures during the day, ultimately a strong buying pressure drove the price back up. The colour of the body can vary, but green hammers indicate a stronger bull market than red hammers.

Will SNDL Stock Price Escape From This Declining Pattern? – The Coin Republic

Will SNDL Stock Price Escape From This Declining Pattern?.

Posted: Sun, 26 Mar 2023 07:00:00 GMT [source]

Discover the range of markets and learn how they work – with IG Academy’s online course. In other words, the market has explored upward and downward options but then settles at more or less the same opening price – resulting in no meaningful change. On the 28th of December 2021, a doji appeared after four green sessions, creating doubt about the bulls’ momentum.

Formation of Spinning top Candlestick Pattern

The main difference is a spinning top always has long wicks or shadows on either side, indicating a large variance in the high and low. A spinning top also signals weakness in the current trend, but not necessarily a reversal. Since market is known for its indecision based behavior, this candlestick patter appears very often in the market. Below, we are going to show you the two types of spinning top patterns combined with Fibonacci support and resistance levels – bullish and bearish spinning top patterns. Since candlestick patterns are representations of market action, they give us interesting insights into what the market has been up to.

- I consider a spinning top candlestick as a potential reversal candlestick in the context of where it forms on a price chart.

- Thankfully, there are two additional methods that we can use to confirm the spinning top patterns that offer the best trading opportunities, which we incorporated in our trading strategy below.

- This pattern is formed when opening and closing prices are almost similar or very close to each other.

- Such an analysis will protect the trader from straying away from the trading pattern and stick within the risk management plan.

This ended up being a reversal candle, as the price proceeded lower. A step by step guide to help beginner and profitable traders have a full overview of all the important skills (and what to learn next 😉) to reach profitable trading ASAP. But for my case, I don’t consider a spinning top candle as a neutral candlestick at all. A spinning top with low volume on the other hand may indicate that the market is about to make a big move and one should look for the break of the candle on either side. The close and open prices on a spinning top are never far apart, regardless of whether the close is above or below the open. Another simple yet effective filter could be to demand that the close is the highest close five bars back for an overbought market, and the lowest close 5 bars back for an oversold market.

The upper shadow of spinning top candle

Candlesticks are so named because the rectangular shape and lines on either end resemble a candle with wicks. Each candlestick usually represents one day’s worth of price data about a stock. Over time, the candlesticks group into recognizable patterns that investors can use to make buying and selling decisions. https://g-markets.net/ The fact that the lower shadow is present indicates that the bears did try to drive the market lower. The real body would have been a long red candle as opposed to a small candle if the bears had been successful. Consequently, this might be viewed as a failed attempt by the bearish to drive the markets down.

The real body—rather than actually being a short candle—would have been a long blue candle if the bulls had been truly successful. Consequently, this might be viewed as a failed attempt spinning top candlestick pattern by the bulls to push the markets higher. In the other direction, a bearish spinning top pattern occurs at the top of a trend and may signal a price reversal and a new trend direction.

Spinning top candlestick pattern summed up

Using the example above, the succeeding candle should close lower than the wick of the Spinning Top. Without this confirmation, the signal of trend reversal may not be established, and uncertainty remains in the market. The logic behind the indecision shown in the market during the formation of a Spinning Top is simple – while the candle was forming, traders moved prices both higher and lower throughout the chart period.

It signifies a peak or slowdown of price movement, and is a sign of an impending market downturn. The lower the second candle goes, the more significant the trend is likely to be. A spinning top appearing in strong downtrend indicates that the bears are starting to lose control.

Inverse hammer

By signing up as a member you acknowledge that we are not providing financial advice and that you are making the decision on the trades you place in the markets. We have no knowledge of the level of money you are trading with or the level of risk you are taking with each trade. As such, you need to use this candle pattern as another confluence trading tool to predict a trend reversal and combine it with other technical indicators in order to confirm the reversal. In this article, we’re going to take a closer look at the spinning top candlestick pattern.

The spinning top on the far left formed at the start of a consolidation phase and the remaining two spinning tops at highs prior to strong bearish reversals. Trading the spinning top candlesticks can be profitable, but it requires patience and discipline to wait for confirmation before entering trades. It’s important to always manage risk by using stop-loss orders and setting realistic profit targets.

Write a Comment